All Resource Articles

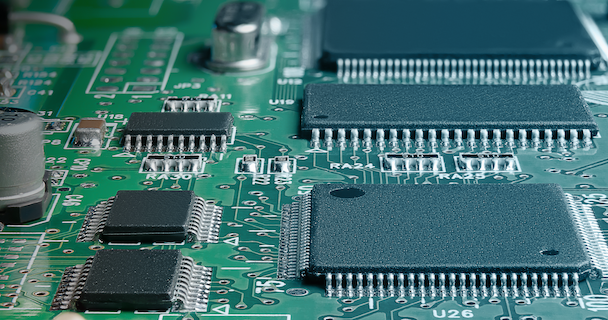

Semiconductor Industry News - April 2024 Update

Updates on the semiconductor industry, technology breakthroughs, and market trends.

The Rise of Natural Disasters and Their Impact on the Industry

Taiwan's recent earthquake revealed just how fragile countries are to unexpected natural disasters, despite preparation. Severe weather phenomena, also known as "billion-dollar" weather events are on the rise and could be catastrophic for the semiconductor supply chain if geopolitical diversity is not prioritized.

Top 4 New Innovative Technologies in Aerospace and Defense in 2024

The aerospace and defense industry is digitalizing with new, innovative technology set to change the very fabric of modern day A&D operations.

Q1 2024 Electronic Components Lead Time Report Highlights

Sourcengine's overview of lead time and price trends in the electronic components market for Q1 2024.

As the Market Rebounds, Smuggling and Counterfeit Concerns Rise

As chip demand recovers and export restrictions on coveted chips remain worries over smuggling operations and counterfeit components rise.

Electronic Component Market News - January 2024 Update

Updates on supply chain shortages, excess inventory challenges, lead time updates, and more can be found here.

The Semiconductor Market Outlook for 2024 - Shortage? Excess? Or Stabilization?

The electronic components industry has experienced a shortage and glut in quick succession, what is in store for 2024? Let's find out.

Selling Your Electronic Excess in 2024

A rebound is coming for the electronic components market, but excess inventory will remain a challenge through the first half of 2024. Now is the best time to clear excess electronic components from your warehouse.

Semiconductor Industry News - December 2023 Update

Updates on the semiconductor industry

Important Sourcengine Updates in 2023

2023 has come to an end. As we finish off the year with holiday cheer and dazzling fireworks, let's review all the important changes that came to Sourcengine in 2023.